Premium Services for Investors

Cumulative Returns Since Inception: 326%

The I/O Fund's cumulative return outperforms the Nasdaq-100's 174% return during the same period*

- The I/O Fund’s cumulative returns outperformed the Nasdaq-100 by 152% and outperformed the S&P 500 by 192%.

- Since inception, the I/O Fund has a lead over institutional technology portfolios by 294%.

- An investment of $10,000 with the I/O Fund's picks at inception versus other all-tech portfolios would see a portfolio value of $42,552 with IOF versus $13,192 with institutional tech-focused portfolios. The difference in value is 223%.

*The I/O Fund is a research site that manages a portfolio in real-time. Annual results are audited by a 3rd party accounting firm for verification. For more information, reference the comparison chart →

I/O Fund outperformed popular tech-focused innovation funds in 2020, 2020-2021, 2021, 2022, 2023, and 2024. Read about our 2025 results here.

Our premium members are equipped with research and are alerted in real time of our every move. Join the I/O Fund as a Premium Member.

I/O Fund continues its Staggering Lead in the Tech Sector

The I/O Fund has achieved a 326% cumulative return since its May 2020 debut. The team’s 29.2% annualized return has outpaced both broad market indexes and institutional tech-focused funds. Continuing years of outperformance, the I/O Fund achieved a 37% portfolio return in 2025. When excluding cryptocurrency, the team’s equity strategy delivered a staggering 56% return, a result that ranks the I/O Fund team among the highest-performing investment teams in the United States on both an annual and cumulative basis.

While our track record has been exemplary, past results are not a guarantee of future outcomes. Please note that we are not financial advisors and consult your financial advisor before making any decisions.

The Power of Risk Management

I/O Fund owes its lead over other all-tech portfolios to technical analysis.

Portfolio Manager, Knox Ridley’s manages the portfolio in real-time, providing readers with weekly webinars, trade alerts and charts to show where the I/O Fund plans to buy and sell key positions. His active management style has led to an exemplary period of outperformance during some of the more volatile years in technology investing.

From 2022, Ridley started using an automated hedge to drive outperformance.

"The million-dollar or even billion-dollar question that has yet to be answered is how to not simply participate in tech, which anyone can do, but rather how to safely participate in tech. The I/O Fund set out to be the first to answer this question, which is why our returns significantly outperform buy-and-hold strategies,"

Ridley is known for creatively managing high-risk assets, including long-term positions such as Bitcoin, Nvidia, as well as temporary positions such as Super Micro’s meteoric rise in 2024, which he closed with over 200% gains from our original entry in mid-2023. Has a nearly impeccable record on Bitcoin, buying at $7K–$10K, trimming at $58K, and re-entering at $15K–$16K ahead of the next rally to $100K, and trimming at the peak.

He issues real-time trade alerts to research subscribers for every stock entry and exit plus offers a pie chart of the portfolio’s allocations. Investors gain access to Knox's risk management strategies when they register for Advanced Market Signals.

Behind I/O Fund's Excellent Portfolio Gains

I/O Fund owes its lead to research from rare talent, Beth Kindig

Lead Tech Analyst, Beth Kindig, is a veteran of Silicon Valley, who is regularly featured in Tier 1 media, including FOX business, CNBC, and Bloomberg. Her deep-dive research and systematic fundamental analysis have helped the firm:

- Build its highest allocations in the complex semiconductor industry, which was the best-performing sector in tech in 2021, 2022, 2023, 2024, and 2025.

- Impeccable timing on Nvidia and other AI stocks led to the I/O Fund having one of the highest allocations to AI on record at 45%. Previously, the firm was early to cloud in 2019, then rotated into AI in 2022. Today, the portfolio remains overweight with lesser-known AI stocks with an average of 95%+ allocation.

“We are unrivaled when it comes to choosing artificial intelligence winners. Nvidia was our highest allocation, yet there are many other AI winners the I/O Fund is poised to capture. We beat Wall Street to an explosive moment for AI and we plan to beat Wall Street again to other AI leaders,”

Kindig is often featured in Tier 1 media including Bloomberg, CNBC and Fox Business Network for the quality of her research -- these coveted spots are reserved for only for the very best analysts in Wall Street.

I/O Fund Cumulative Returns of 326% More Than Double the S&P 500.

The I/O Fund’s cumulative returns of 326% have more than doubled the S&P 500 since our inception and have a lead of 294% over institutional all-tech portfolios. The team is dedicated every day to continue outperforming the large corporations I/O Fund competes with.

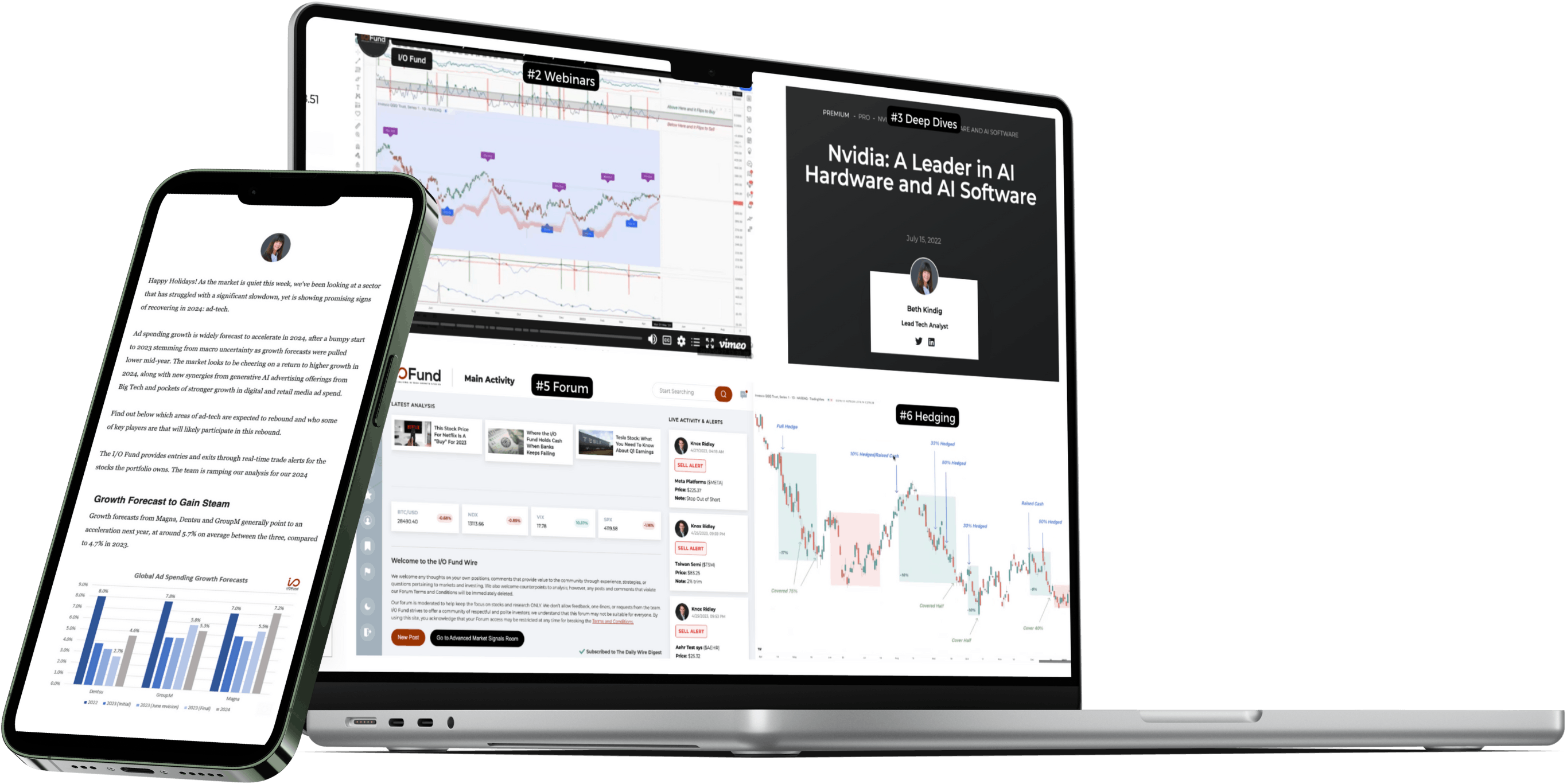

Unlock 5 Key Benefits

The mission statement of the I/O Fund is to bring the accountability that institutional investors demand to retail investors.

- Institutional Level Analysis

- LTBH & Broad Market Webinars

- Market Updates

- Real-Time Trade Alerts with BONUS Automated Hedge Signals

- Portfolio of 10-15 Positions

Choose a verified team with proven results.

I/O Fund Reviews

Thank you Beth, you are awesome

Beth, your analysis is second to none. When I saw your FOX News interview on YouTube, I had to check out your company and become an I/O Fund member. I also love how you take complex technical topics and explain them in simple terms that everyday folks like me can understand. Wishing your I/O fund can ride this AI story to new heights. So glad you stared your own company.

NVIDIA now vs. Apple 20 years ago - For individual investors, diversification is a myth. Retail investors don't have time to follow and analyze X number of stocks in Y number of fields, just in the name of diversification. 20 years ago, I had thousands of Apple shares. I didn't know what I was doing, so every time it made a little money, I sold a little AAPL. I also tried to be too cute with covered calls. I was in the boat to the promise land and I jumped out. I missed the boat. If I had kept all my shares, I could've retired by now.

NVIDIA is now my second chance. I had bought some NVIDIA in 2021 and 2022 and more in Dec of 2023 when I sold all my other stocks and just bought NVIDIA. Now 100%+ of my stock portfolio is NVIDIA (including 1200 on margin). Plan to hold this for the next 5-10 years.

When we marry, we marry one person. When we get a pet, we get one pet, maybe two. When we work, we work for one employer at a time. So yeah, I believe in Jensen Huang the way I believed in Steve Jobs. For me, while it is very tempting to sell NVIDIA and buy other AI related companies. I am sticking with NVIDIA.

I love your analysis on the whole AI wave. No one does it as well as your firm. Thank you for all you do and who you are.

Alex

PS - no reply necessary.

Alex S

Subscriber since February 2024

I am a fairly new member and I just wanted to comment on what a great job and service you provide. Your analysis is very thorough and most importantly full of statistics and facts which helps me distill what matters most.

I particularly really learn a lot from Knox Ridley’s weekly chart Webinar’s which are extremely helpful in taking the emotion out of trading and rather focusing on buy/ sell ranges and momentum.

He does an outstanding job simplifying macro factors and explaining stock movement patterns, keeping it simple, and filtering out the noise that can be very confusing.

Thank you very much,

- Bret S

Bret S

Subscriber since January 2025

Beth, your comments are always thoughtful, but here your perspectives illustrate superb intellect, Street savvy and are, seriously, outstanding. Anyone following this story should listen to your comments a few times... they will imo prove to be prescient wrt revenue and earnings growth.

WTH is the matter with the two dufus interviewers from Bloomberg laughing as you were, being as nice as possible, not to repeat your insightful comment "Never underestimate Wall Street's ability to miss the bigger picture" -- shared when you first dismissed the comments about margin concerns. I think they should both be fired for laughing at your steadfast bullishness when you tried not to call him an idiot for repeating his negatyive bias and focusing on why gross margin clip of 2% for maybe a Q (but being restored by year end) . Incredibly unprofessional on their part -- and demonstrating that neither one of them understand how powerfully correct you were on every one of your points here.

As a 35 year Street veteran with top of hedge fund performance metrics over the entire time, I simply want to share that I think this was actually one of the most insightful and powerful reviews I have ever seen any analyst share. Congratualtions to you! It will be fun to look back on this as the Street scrambles to take estimates up more than 50% for FY2026.

@jbluesman1

YouTube Channel Subscriber

I want to say "thank you" to Beth, Knox, and everyone else behind the scenes for your excellent and extremely high quality work. I am so happy that I found you. You are by far the best research and market information service that I have ever used.

Thank you, thank you, thank you.

Eric G

Subscriber since November 2025

The product offered is the best of all the things I subscribe for (Real Vision, Armstrong, free ARK). Keep up the good work. Great performance and content. I have made numerous recommendations to others to your service . It’s informative and intellectually stimulating.

Stewart W

Subscriber since December 2023

I just wanted to take a moment to sincerely thank your entire team and let you know how important your work has been to me over the years.

I’ve been with you for a long time now, and the guidance from Knox and Beth has been absolutely vital to both my peace of mind and my investing discipline. Beth’s technical analysis and technology insights, along with Knox’s calm, emotionless, and highly disciplined trading approach, have made a tremendous difference in my results and confidence as a recently retired retail investor.

Because of your work, I’ve been able to stay steady through the market’s ups and downs. I truly believe I would have missed major gains and likely taken significant losses to my principal if not for your consistent direction and education. After listening to Knox’s Zoom meeting last night, I told my wife I’m genuinely not worried. I’ve seen this kind of disciplined decision-making play out successfully time and again. Even when certain moves like the Bitcoin trims looked questionable in the moment, they proved once again to be right.

Beth’s continued coverage of emerging technology and AI infrastructure has also been incredibly valuable and forward-looking. It’s reinforced my confidence and commitment I consider myself a lifelong member!

Please extend my thanks to everyone behind the scenes as well. I know it takes a dedicated team to deliver this level of quality and consistency. I’m truly grateful for all that you do.

With sincere appreciation,

Frank P

Frank P

Subscriber since December 2020

Not Ready to Invest in Premium but still want FREE Tech Stock Analysis?

Join I/O Fund's community of 40,000+ investors that receive weekly tech stock analysis. Get Free Weekly Tech Stock Analysis on the Best Tech Stocks.

AI Stocks: Why the “Inference Stage” Will Make Investors the Most Money in 2026

While the media warns of an “AI Bubble,” the real money is just beginning to flow. In this exclusive interview with Charles Payne, tech visionaries Beth Kindig (I/O Fund) and Ivana Delevska (Spear Invest) explain why we are exiting the R&D phase and entering the massive Inference & Monetization Stage of 2026.

Meta & Google: The Secret AI Winners? | Beth Kindig’s 2026 AI Stock Forecast

While many wrote off Meta and Google in the AI race, the data tells a different story. I/O Fund Lead Tech analyst Beth Kindig joins Charles Payne to break down why Meta is now #2 in AI revenue—second only to Nvidia—with a staggering $60 billion run rate. Explore why the $15-$20 trillion AI impact is about embedding LLMs into enterprise workloads, not just search.

AI Data Center Shortages & Investment Insights | Bloomberg Tech Interview

I joined Bloomberg Tech in New York to discuss critical shortages from the AI data center buildout and how investors can navigate AI stocks in this complex market. Insights from this interview highlight key trends shaping the AI industry and investment opportunities.

The $20B Proof: How OpenAI’s Revenue Ramp is Saving the AI Trade

Is Big Tech overspending on AI, or are we on the verge of the greatest monetization wave in history? In this deep dive, Beth Kindig (Lead Tech Analyst at I/O Fund) joins Bloomberg Technology to discuss why the "Drunken Sailor" spending narrative might be missing the bigger picture.

$20 TRILLION BY 2030: Beth Kindig on Why Nvidia's Growth is Still Accelerating

In this segment, I/O Fund Lead Tech Analyst Beth Kindig discusses why NVIDIA's (NVDA) record-breaking performance is showing no signs of slowing down, even after clearing high market expectations. She dives into the company's QoQ growth, new product cycles, and the massive drivers that justify a staggering $20 Trillion market cap forecast by 2030. This is a must-watch analysis for anyone invested in semiconductors, AI, and Big Tech infrastructure.

Nvidia's $20 Trillion Thesis: Why the Cloud GPU Sell-Out & 25% Growth Silences Naysayers

I/O Fund Lead Technology Analyst Beth Kindig joins Fox Business to break down the incredible post-earnings results for Nvidia and defend her aggressive $20 Trillion market cap forecast by 2030. Despite market volatility and "naysayers" who continue to question the AI boom, Kindig asserts that the fundamentals "get better and better and better".