Get Free Weekly Stock Analysis

Featured Across Top Finance & Tech Platforms

Beth Kindig, lead tech analyst at I/O Fund, is frequently featured on major outlets such as Fox Business, Network, Bloomberg, Forbes, Real Vision, CNBC, MarketWatch, Yahoo! Finance, Nasdaq, TD Ameritrade, and more for her accurate calls on top tech companies. Starting her career in Silicon Valley in 2010, Beth Kindig has become a trusted voice in analyzing the world’s most influential tech stocks.

As Seen In

Claim Your Free Stock Tip Today!

AI Stock: The Quiet Challenger to Nvidia

Discover why the I/O Fund believes that this AI networking and ASIC powerhouse is poised to become the next market favorite.

Customer Reviews

Read reviews from I/O Fund customers to see how our stock analysis worked for them.

Thank you Beth, you are awesome

Beth, your analysis is second to none. When I saw your FOX News interview on YouTube, I had to check out your company and become an I/O Fund member. I also love how you take complex technical topics and explain them in simple terms that everyday folks like me can understand. Wishing your I/O fund can ride this AI story to new heights. So glad you stared your own company.

NVIDIA now vs. Apple 20 years ago - For individual investors, diversification is a myth. Retail investors don't have time to follow and analyze X number of stocks in Y number of fields, just in the name of diversification. 20 years ago, I had thousands of Apple shares. I didn't know what I was doing, so every time it made a little money, I sold a little AAPL. I also tried to be too cute with covered calls. I was in the boat to the promise land and I jumped out. I missed the boat. If I had kept all my shares, I could've retired by now.

NVIDIA is now my second chance. I had bought some NVIDIA in 2021 and 2022 and more in Dec of 2023 when I sold all my other stocks and just bought NVIDIA. Now 100%+ of my stock portfolio is NVIDIA (including 1200 on margin). Plan to hold this for the next 5-10 years.

When we marry, we marry one person. When we get a pet, we get one pet, maybe two. When we work, we work for one employer at a time. So yeah, I believe in Jensen Huang the way I believed in Steve Jobs. For me, while it is very tempting to sell NVIDIA and buy other AI related companies. I am sticking with NVIDIA.

I love your analysis on the whole AI wave. No one does it as well as your firm. Thank you for all you do and who you are.

Alex

PS - no reply necessary.

Alex S

Subscriber since February 2024

I am a fairly new member and I just wanted to comment on what a great job and service you provide. Your analysis is very thorough and most importantly full of statistics and facts which helps me distill what matters most.

I particularly really learn a lot from Knox Ridley’s weekly chart Webinar’s which are extremely helpful in taking the emotion out of trading and rather focusing on buy/ sell ranges and momentum.

He does an outstanding job simplifying macro factors and explaining stock movement patterns, keeping it simple, and filtering out the noise that can be very confusing.

Thank you very much,

- Bret S

Bret S

Subscriber since Jan 2025

Beth, your comments are always thoughtful, but here your perspectives illustrate superb intellect, Street savvy and are, seriously, outstanding. Anyone following this story should listen to your comments a few times... they will imo prove to be prescient wrt revenue and earnings growth.

WTH is the matter with the two dufus interviewers from Bloomberg laughing as you were, being as nice as possible, not to repeat your insightful comment "Never underestimate Wall Street's ability to miss the bigger picture" -- shared when you first dismissed the comments about margin concerns. I think they should both be fired for laughing at your steadfast bullishness when you tried not to call him an idiot for repeating his negatyive bias and focusing on why gross margin clip of 2% for maybe a Q (but being restored by year end) . Incredibly unprofessional on their part -- and demonstrating that neither one of them understand how powerfully correct you were on every one of your points here.

As a 35 year Street veteran with top of hedge fund performance metrics over the entire time, I simply want to share that I think this was actually one of the most insightful and powerful reviews I have ever seen any analyst share. Congratualtions to you! It will be fun to look back on this as the Street scrambles to take estimates up more than 50% for FY2026.

@jbluesman1

YouTube Channel Subscriber

I am very happy to be part of I/O Fund community and get such valuable guidance in managing my assets alongside your team. Thank you for your generous lifetime offer. I wish to be with you in this journey as long as possible.

Tiberiu T

Subscriber since July 2024

The product offered is the best of all the things I subscribe for (Real Vision, Armstrong, free ARK). Keep up the good work. Great performance and content. I have made numerous recommendations to others to your service . It’s informative and intellectually stimulating.

Stewart W

Subscriber since December 2023

Your company is a rare and remarkable example of professionalism and honesty in this industry.

Dr. Stéphane D

Subscriber since September 2023

I am more than happy for the brilliant, honest, and most useful information I receive from i/o. After having tried many other sites, this is by far and without any comparison, the best service offered today.

Dr. Stéphane D

Subscriber since September 2023

I am a new investor and if it were not for the I/O Fund I would have lost a lot more money in 2022 down turn. Plus, I would have completely missed the semis surge of the last 12-18 months.

B Saf

Subscriber since May 2021

I am beyond satisfied with the service as a whole. I've found nothing like it. The research and investment theses are second to none, the technical analysis is easy to follow once you make the effort to learn a basics of Elliot wave, which the site provides and with Knox's consistent refreshers. I will remain a member until the service ends. The quarterly webinars form Beth and Knox are extremely helpful.

Robert O

Subscriber since December 2020

Good service. I subscribe because the information is completely outside my own knowledge base, and I consider myself to be a sophisticated investor with a very reasonable long term track record.

Michael W

Subscriber since March 2024

I love Beth's earnings reports and technical deep dives. I've been investing in equities for over 30 years and they are by far the most thorough, complete and unbiased reports I've ever read. Outstanding. I think the amount of content is right, when you have something important to say you say it and I welcome it.

Bob K

Subscriber since November 2023

Beth, Keep up the good work. You have helped make me a lot of money and I enjoy all your commentary. Ed

Ed M

LinkedIn Follower

I’ve been a member for about 2 years and love it. I’ve had advisors, various subscription services and IO is certainly the one that ticks the boxes in terms of what I was searching for, market analysis, tech industry and company education. I enjoy learning new investing and trading techniques/rationale which has assisted me in being more aware and understanding of sentiment.

Peter K

Subscriber since July 2020

I’ve subscribe to Beth’s newsletter for four years. She is by far the best out there and her analysis and recommendations are spot on!

@KH-sl8py

YouTube Channel Subscriber

As a foreign subscriber to this service, I just want to thank you Knox for your crystal clear language. being able to follow your approach is worth every penny!

Jonas

Subscriber since May 2020

Hi IO Funders, I am a new subscriber for about a month now. I have had lots of research from large brokers and smaller shops that make trade recommendations. this email is to say I am loving your work and how you trade. the combo of the Technical analysis and fundamentals is amazing. And I agree fully with a comment from Beth on the last update that having a narrow list of top quality names is the way to go vs too many. This combined with the macro overlay plus Knox's TA-based analysis and tactics are really great.

glad to be aboard

joe b

colchester, ct

ps - i joined after your recent real vision presenation

Joseph B

Subscriber since September 2023

I wanted to share with you both how grateful and appreciative to you both! When I first saw Beth on Charles Payne’s show I was blown away and then was thrilled to find out about the IO fund!

Your work, analysis and knowledge is beyond amazing and I am so grateful for everything! I just wanted to share my thoughts and tell you how thankful I am for both of you!

Thank you!

Gina

Gina C

Subscriber since February 2025

Beth & co.,

Very impressive as were your results after reviewing your website.

Became a premium subscriber just under the wire 7-31. THANK YOU VERY MUCH!

Enjoy your in depth but digestible research and commentary on your suggested investments. Look forward to a long and profitable relationship with your exceptional organization.

Mark F.

PS - Have spent many thousands of dollars on investment advice over the years and, so far, yours is the most impressive!!

Mark F

Subscriber since July 2025

Notable Wins in Crypto Investing, AI and Tech Stocks

- AI Stock Leadership: First called Nvidia (NVDA) as an AI stock in 2018 at $3.15 — delivering over 4,000% gains through 2024. Issued 25 Nvidia stock analyses before Wall Street caught on.

- High AI Exposure: Maintained 45%+ allocation to AI stocks in 2023, one of the highest on record. Today, the portfolio remains overweight lesser-known AI stocks with an average of 70%+ allocation.

- Crypto Investing Strategy: Achieved over 1,250% returns in Bitcoin, buying at $7K–$10K, trimming at $58K, and re-entering at $15K–$16K ahead of the next rally.

- 2024 Stock Analysis Wins: The team had ten positions beat the Nasdaq with Super Micro +243%, CrowdStrike +87%, Netflix +164%, plus altcoin trades and AI semiconductor gains.

- Proven Performance: The tech stock portfolio returned +57% in 2023, which would have ranked #4 of 1,191 funds in WSJ’s Winners’ Circle.

- Consistent Outperformance: Many stock portfolios do not beat the indexes. Meanwhile, the I/O Fund has outperformed the indexes and tech portfolios in every independent audit since inception.

Beth Kindig is a Leading Analyst on

Nvidia Stock

Watch Beth Kindig discuss Nvidia's Stock on Fox Business and CNBC. Beth Kindig was early to Nvidia's stock with an entry as low as $3.15 for returns of 4,000% through 2024. Her firm has a leading AI stock portfolio with more than 50% allocation to AI stocks.

Every week, Beth Kindig writes on AI stocks and crypto. Join tens of thousands of investors who get Kindig's weekly stock analysis here.

Get our free weekly analysis here

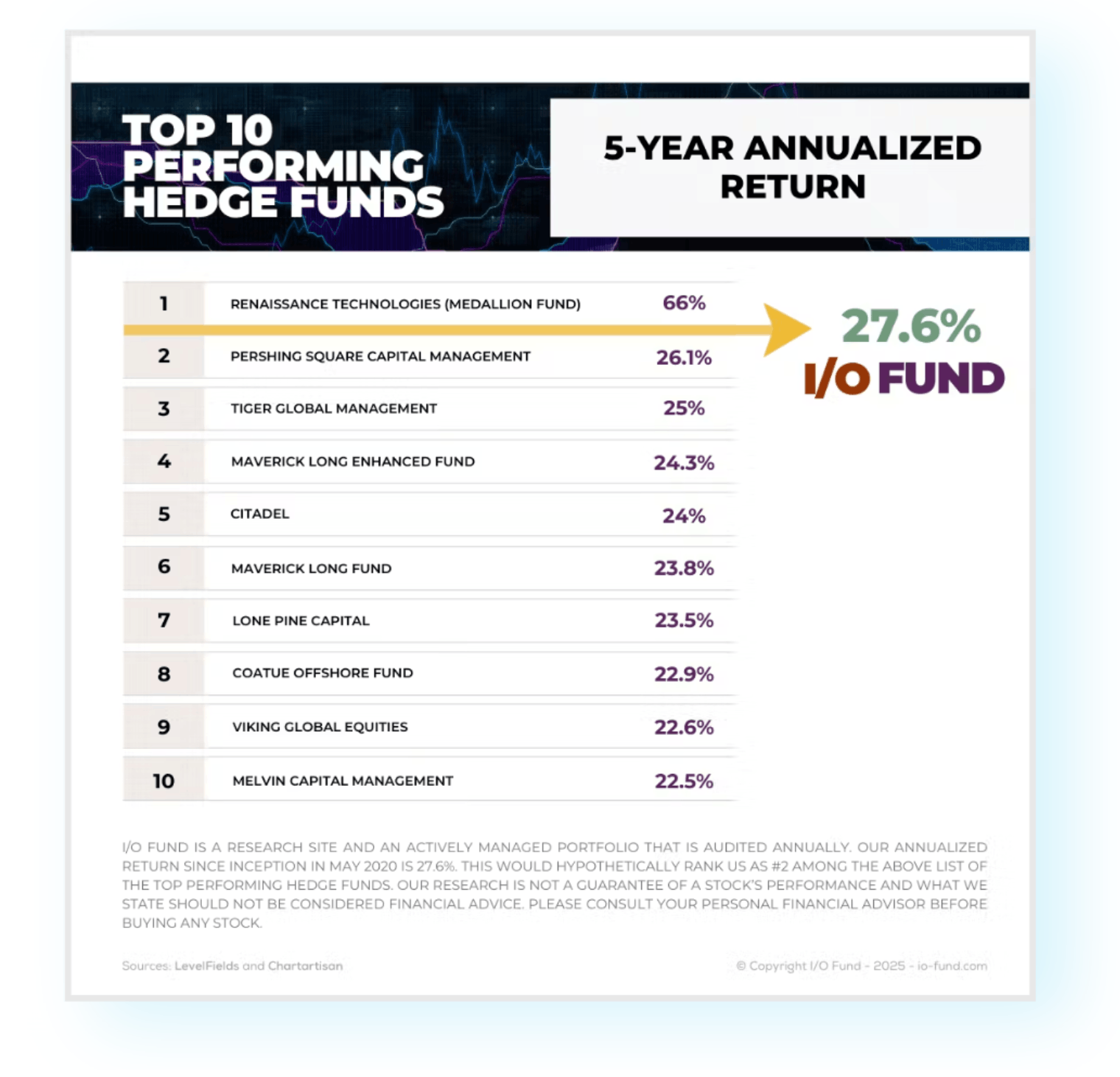

Our five-year cumulative returns of 210% would place us as #2 if we were a hedge fund and #5 if we were an ETF.

What Investor Plan is Right for you?

Free Stock Analysis

plans start at

$0/year

- Free weekly stock analysis delivered to your inbox

Pro Deep Dives

plans start at

$549$474/year

LIMITED TIME OFFER*

Use Promo Code: PRO75

- View the I/O Fund’s top-performing portfolio

- Unique deep dives and Research – this is the cornerstone of our site as Beth is known for being first to a thesis

- New stock tips – carefully selected for a top-performing tech portfolio

- Critical fundamental updates on the I/O Fund’s portfolio positions

- Quarterly webinars to prepare you for earnings season

Upgrade to Advanced for real-time trade alerts and weekly portfolio webinars held Thursdays at 4:30 p.m. EST

Advanced Market Signals

plans start at

$849$749/year

LIMITED TIME OFFER*

Use Promo Code: ADVANCED100

- You get everything from PRO!

Plus, these additional Advanced benefits ...

- You get everything from PRO!

- Real-time trade alerts for every position the I/O Fund buys and sells sent to your phone and email

- Weekly webinars with the I/O Fund portfolio manager covering the I/O Fund positions held Thursdays at 4:30 pm EST.

- Detailed buy and sell plans with technical analysis for every trade the I/O Fund makes

- Broad Market analysis that covers all major US markets, several global markets, crypto, bonds, and futures.

- Market Updates: Our portfolio manager provides regular market updates and technical analysis on portfolio stocks, helping you navigate market fluctuations and stay informed for long-term success.

Discovery

plans start at

$399/year

- Our newest plan: Fast-paced research on new stock ideas

- Two stock ideas per month with comprehensive, deep dive analysis

- Technical setups provided for stock ideas

- Be the first to know about exciting companies in the tech sector

- NOTE: the IOF Portfolio and Trade Alerts are only available in the Advanced Tier

2. Register Your Investor Type

What type of investor are you? Register as an Individual, LFA or Institutional Investor.

Individual Investor

An Individual Investor includes a retail investor who is not licensed and researches and/or invests on their own behalf.

LFA Investor

A Licensed Financial Advisor (If you hold a FINRA license and work as a financial advisor and/or work for a Registered Investment Advisor, please register as a Licensed Financial Advisor/RIA.)

Institutional Investor

An Institutional Investor includes working in any capacity for a Private Client Group within a Registered Broker-Dealer, Hedge Fund, Pension Fund, Labor Union Fund, Endowment Fund, Mutual Fund, or Investment Management Company that advises ETFs.

Features & Benefits of I/O Fund for Investors

Integrity You Can Trust

The I/O Fund is the only retail-level portfolio that is fully audited — a level of transparency rarely seen in the industry.

Deep Dives from a Leading Tech Analyst

Beth’s stock analysis is regularly featured in Tier 1 media outlets — the gold standard of financial journalism.

Real-Time Trade Alerts

Get instant notifications for every buy and sell from Knox Ridley, a Portfolio Manager whose performance is beating Wall Street at its own game.

Advanced Market Signals

Stay ahead of market shifts with broad market updates and technical analysis directly from Knox Ridley—tools trusted by serious investors.

Exclusive Webinars with Our Portfolio Manager

Access members-only sessions with Knox — perfect for listening on your commute or catching up during lunch.

Meet the Stock Analysts

Beth Kindig

Lead Tech Analyst

Beth Kindig has 14 years of experience in tech analysis. From gracing stages and news outlets in Silicon Valley beginning in 2011 to outpacing Wall Street’s top hedge fund managers from 2020 onward, her bold calls on complex tech stocks have earned widespread praise. She is a staple in Tier 1 media, writes a weekly newsletter for 36,000 investors, and has a highly engaged Twitter following of more than 160,000.

Beth is one of the best AI investors and analysts on record. Going into 2023, she held a 45% allocation in AI semiconductors compared to legendary investors such as Stanley Druckenmiller at 29%. Known as the “Queen of Nvidia,” she has also delivered dozens of prescient, accurate stock calls through her paid research platform.

Knox Ridley

Portfolio Manager

Knox Ridley began his career in 2007 as a licensed ETF consultant, specializing in portfolio optimization. In this role, he worked with hundreds of financial advisors, RIAs, and CIOs at large institutions, gaining exposure to a wide range of investment strategies. After navigating the Great Financial Crisis, Knox developed a strong focus on risk management within growth-oriented portfolios. This approach allows Premium Members of the I/O Fund to pursue upside potential in technology investments while employing strategies to mitigate inevitable market downturns.

A keen observer of macroeconomic trends, Knox is trained in Fibonacci Trading, Elliott Wave Theory, and Gann Cycles. Unlike most portfolio managers, he integrates advanced technical analysis with automated quantitative signals to manage risk and identify high-probability, risk/reward opportunities. As Portfolio Manager of the I/O Fund, Knox has consistently outperformed his benchmark, as well as leading Wall Street funds, since inception.

One of the Only Audited Tech Stock Portfolios for Individual Investors

Launched in May 2020, our audited tech portfolio has delivered 5 years of transparent results with a 210% cumulative return.

We’ve outperformed the Nasdaq, doubled the S&P 500, and surpassed other all-tech portfolios by 219%. 📈

Unlike buy-and-hold strategies, we carefully pick winners and actively manage risk through hedging and cash. With a 27.6% annualized return, our performance ranks among the world’s top actively managed portfolios — surpassing many of Wall Street’s best-known firms.

Source: Levelfields and Chartartisan While our track record has been exemplary, past results are not a guarantee of future outcomes. Please note that we are not financial advisors and consult your financial advisor before making any decisions.

Investor FAQs

- ▼

What stocks have the highest conviction?

- ▼

What is your portfolio’s performance?

- ▼

Where can I get information about hedging?

- ▼

I am a new member. How do I build my portfolio?

- ▼

What cryptocurrency exchange should I use?

- ▼

What’s included in the free report?

- ▼

Can I cancel anytime?

- ▼

How are trade alerts delivered?

❓Email us with any questions or to upgrade your plan.

Contact UsJoin Our 1-Hour Live Stock Market Webinar

Hosted weekly by Knox Ridley, Portfolio Manager at I/O Fund, these premium sessions deliver expert market strategies, stock entry/exit points, and crypto insights.